Prestigious and Accredited Degree : Upon completion of the program, all students will get a Master’s degree from University of Wollongong Australia, a university in the top 1% of the world universities, accord to QS World University rankings. This degree is fully accredited in the UAE by Commission for Academic Accreditation (CAA) and Knowledge and Human Development Authority (KHDA).

The completion of the program will provide students with practical, hands-on, and job-ready skills essential for success in the financial services industry. Some of the key skills acquired through this program include financial analysis where Graduates gain expertise in analyzing financial statements, assessing financial performance, and making informed decisions based on financial data. They also learn to identify, assess, and manage financial risks using various techniques and tools to ensure stability and compliance with regulations. Understanding the intricacies of banking operations, including lending, credit evaluation, and regulatory compliance, is a common component of this program.

Also learn Insurance and Wealth management skills besides data analytics. Given the heavily regulated nature of the financial services industry, students will learn about various financial regulations and compliance protocols. Our program emphasize ethical considerations and the importance of maintaining high professional standards in financial services careers with technology integration.

These skills collectively prepare graduates for a variety of roles within the financial services industry, including positions in banking, investment banking, insurance, financial planning, and more.

You must complete 12 subjects to graduate.

You can complete your master’s degree in 15, 18 or 21 Months 15, 18 or 21 Months depending on:

- The number of subjects you choose to take per trimester,

- The number of trimesters, you choose to study per year.

There are many possible combinations between subjects and trimesters, Some examples are listed in the Tuition Fees section below.

- Chief Financial Officer

- Chief Executive Officer

- Finance Business Partner

- Financial Service and Insurance Managers

- Equity Trader

- Compliance officer

- Corporate Investment Banker

- Corporate Treasurer

- Financial Risk Analyst

- Financial Trader

- Credit Analyst

- Business Analyst

- Foreign Exchange Trader

- Loan Officer

- Bank Liability Manager

- Financial Manager

- Asset Manager

- Financial Risk Manager

- Financial Service Representatives

With the global nature of this degree, you will be equipped to work in any industry in private, semi private or government sector in any region of the world.

- Doctoral Study Opportunities : Should students wish to pursue further research after completing this Master’s degree, UOW Dubai offers a PhD program under the Faculty of Business

- Fall: September

- Winter: January

- Spring: April

- Summer: July

- Bachelor’s degree: Regular Entry: 3.0 GPA and above

- Probation Entry: 2.5 to 2.99 (Probation means you will have to get an average of 55% in the 1st 3 subjects of your master’s degree)

- GFC: Less than 2.5 (students are required to take 3 General Foundation Classes during 1 month and cost 2900 MAD each)

- IBT 79 – or IELTS 6.0 (5.5 might be considered if GPA is 3.0)

NOTE: Graduates who studied their Bachelor’s in English are exempted from the TOEFL and IELTS

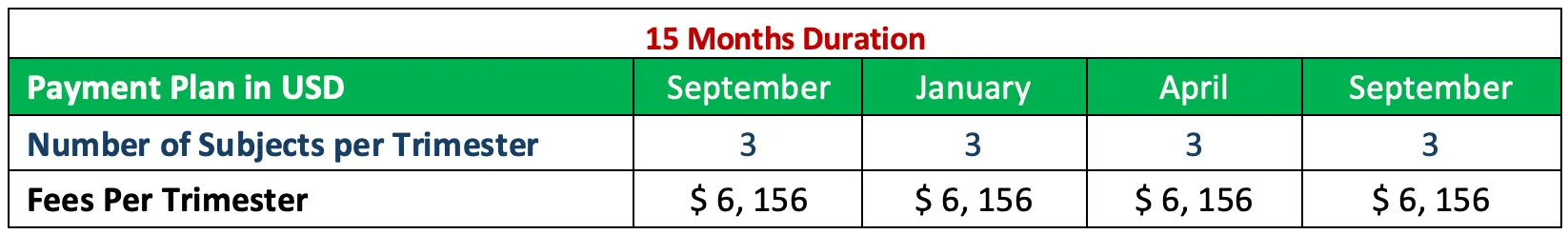

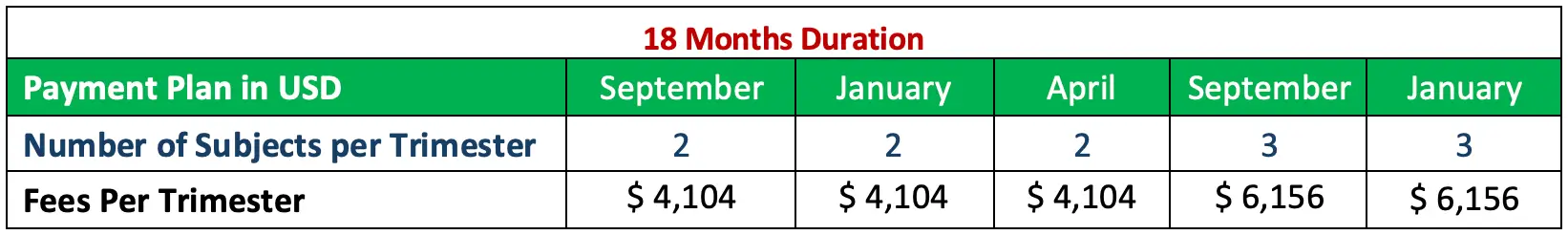

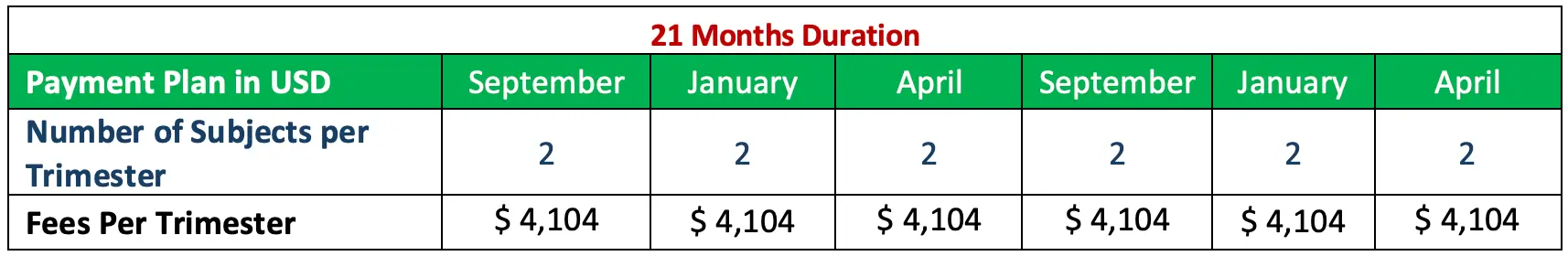

Total Tuition Fee Including a 20% Bursary: $ 24,624 (each trimester is paid seperatly).

Visa, Insurance, Residency & Security Deposit (the university refunds you back $ 700 once you find a job, or finish your master’s) : $ 2,242.

You must complete 12 subjects to graduate.

You can complete your Master’s degree in 15, 18 or 21 months depending on the number of subjects you choose to take per trimester as detailed in the below 3 tables:

Program Structure

Your program of study is as follows:

| Subject Name | |

|---|---|

| Common Finance Subjects | Financial Statement Analysis for Business |

| Financial Institutions | |

| Quantitave Economic Analysis | |

| Advanced Managerial Finance | |

| Risk Management | |

| Socially Responsible Finance | |

| Specialisation Subjects | Banking Theory & Practice |

| International Banking | |

| Banking, Lending & Securities | |

| Research Capstone Project | Research in Financial Markets & Institutions |

| Electives* | Banking, Lending & Securities |

| Marketing Management | |

| Multinational Financial Management | |

| Financial Strategy | |

| Economics for Modern Business | |

| Islamic Banking & Finance |

* Students are required to choose any one elective from the approved list.

The Master of Applied Finance - Financial Services

The Master of Applied Finance (Financial Services) offers a comprehensive and advanced program designed to equip students with in-depth knowledge of financial institutions, bank management, and lending. Through work-integrated learning and ongoing collaboration with industry, and collaborative peer learning, participants will gain a conceptually sound and practical understanding of the global financial system. Additionally, competing approaches to corporate governance and business ethics will be developed, besides how to provide protection against portfolio, financial and corporate risks.

With a focus on the legal framework governing financial institutions and the intricacies of a bank’s lending process, bank management theory and the securities associated with it, graduates emerge well-prepared to navigate the dynamic landscape of financial services with confidence. The program will also include an emphasis on developing conceptual and practical knowledge relevant to a disruptive financial services sector including key areas such as fin-tech, sustainable financial management and data-driven decision-making.

This specialised concentration opens diverse career avenues in banking, asset management, and other financial sectors, including Credit Analyst, Business Analyst, Foreign Exchange Trader, Loan Officer, Bank Liability Manager, Financial Manager, Asset Manager, Financial Risk Manager, among others, making the graduates highly sought after by employers.